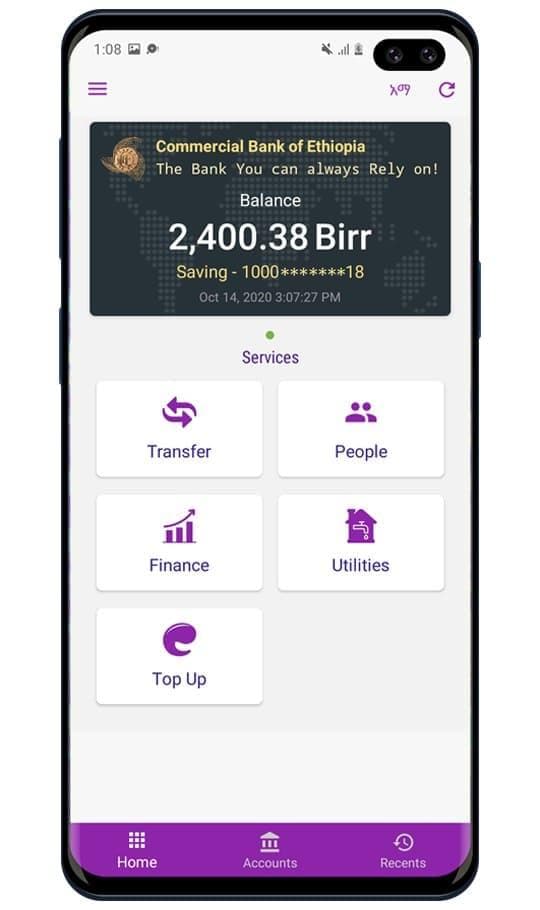

Major CBE Mobile Banking service Category

Transfer

- It allows customers to transfer money from one account to another account or another bank account using mobile banking.

Telecom services:

- It enables customers to the airtime from Ethio-telecom/Safaricom and to pay for postpaid bill payments with mobile banking.

Utilities:

- It enables customers to pay for different services such as electricity, water and other utilities provided by the public.

Government services:

- It allows customers to pay for different governmental services such as payment for Addis Ababa revenue tax, immigration, Ministry of Trade and Industry, Dire Dawa and Somalirevenue tax payment etc

PayFor:

- it allows customers to pay for different fees such as merchant fees, school fees, health payments, donations and Digital Equbetc.

Travel:

- It enables customers to pay for both land(Guzo go, ride driver, Guzo bus ticket &Kelal ticket) and air transport.

Entertainment:

- It enables customers to pay for entertainment channels such as Canal+, DSTV and Webs Prix.

Banking:

- it enables customers to acquire non-financial services such as viewing locked amounts, standing orders, requesting new and replacement ATM/ Visa cards, managing beneficiaries, exchange rate, ATM, branch, CBEBirr agent, and Merchant POS locator and customer feedback.

In addition to the above-mentioned mobile banking service, customers can get the following services at any CBE branch and 951.

- • Channels add: if a customer has only one channel, he/she can request an additional channel in any of the CBE branches • Modify End Date: if the customer’s access date for mobile banking is expired, he/she can appear at any of the branches and request an access date extension. • Channel Reset/Pin Reset/: if a customer forgets their mobile banking PIN, he/she can appear at any of CBE branches and request a PIN reset. • Change Phone Number: if a customer wants to change phone number, he/she can appear at any of the CBE branches and request a phone number change to his mobile banking service. • Mobile phone apparatus change: if a customer wants to change their mobile phone apparatus, he/she can request the service at any of the CBE branches • Blocking a mobile banking user: if a customer has lost his/her mobile phone unfortunately, he/she can appear at any of CBE branches or call 951 and request to block his mobile banking user. • Resume Mobile Banking service: When a customer wants to resume his/her mobile banking service that has been blocked previously, he/she can appear at any of the CBE branches and request to resume the service. • Add/Link/ Additional Account: Any existing customers having an additional account maintained at the T-24 system under the same customer ID, can request to associate additional accounts to his/her mobile banking.

For any complaints about customer service management or any feedback, please use the following options:

- 1. Directly apply to the Branch Manager who created the complaint. 2. Call our customer contact center at 951 for free. 3. Use the feedback option on our Mobile Banking application. In addition; to get up-to-date information, please join our official telegram channel https://t.me/combankethofficial